Are you looking for how you can get loan with bad credit scores in India urgently? Then, you have landed in right place. There are many types of loans that you can be avail to tide over financial uncertainties. Financial emergencies hit you when you least expect it, and sometimes your savings are not enough. When you have done everything possible but are still short of cash to tide over this difficult time, that’s when you need to start thinking of getting a loan.

Here, we have discussed the many types of loans available in the market, especially for a bad credit person. If you require money urgently and have a bad credit score to your dismay, we hope you find we tips and suggestions useful. Nothing is impossible, and it is loan with bad credit scores in India urgently.

Why do you have bad credit scores?

Your credit scores might be low due to many reasons. We have listed them below:

- You would have missed paying your credit card dues.

- You might have missed paying your utilities.

- You would not have been keeping up with your repayments.

- You might have defaulted on your previous loans or not made timely payments.

- Your credit application might have failed.

- You have never taken a loan. Hence you don’t have a financial track record making it difficult for lenders to assess you.

- You might have filed for bankruptcy before

Types of emergency loans

First, you need to arrive at a figure which will safely tide you over this emergency. You go for a loan only when you arrive at this figure and know your savings are not enough. We have listed different types of loan with bad credit scores in India.

- Payday loans are unsecured loans that require very little documentation. The tenure of the loan is the next payday which means you need to repay the entire amount, and you can avail this facility instantly online. It is a boon to salaried professionals who get regular monthly salaries and require emergency funds but have poor credit scores. Several digital lenders instantly approve the loan, and the funds are acquired immediately. The loan tenures are very short, ranging from 2-4 weeks.

- Loans against insurance policies. These loans come in handy if you have a bad credit score. These loans are secured loans with your insurance policy as collateral. Life insurance policies that have a surrender value can be pledged as collateral to banks. These loans are sanctioned quickly and have low-interest rates with flexible repayment tenures.

- Credit card cash advance. Most people don’t know that they can use their credit cards as ATM cards to withdraw money from the ATM. This is an unsecured loan that provides instant cash to you. It doesn’t impact your credit score, and no separate documentation is required. Interest is charged from the day you withdraw the cash.

- Loan against PPF account. It applies to people who own a PPF account with the Government of India. If you have a PPF account, you are eligible for this loan, and it is independent of your bad credit score. You can avail of this facility between the third and sixth year of opening the PPF account, and the loan amount is capped to 25% of your PPF balance. The interest rate charged is 1% higher than the interest rate earned on the PPF scheme.

- Home equity loans are secured loans where your house is the collateral pledged to banks. Depending on the value of your property, banks will approve the loan independent of your bad credit scores. There are no tax benefits for home equity loans, and any default on the payment increases the risk of losing your home.

From the kinds of loans discussed above, you can understand which loan you will qualify for. Now, we will elaborate on where you can seek these facilities.

Places where you can get such loans

You can avail the home equity loans and loans against insurance policies at your primary bank. If you ask your bank manager, he/she will be able to assist you in getting a loan and direct you to the correct department who will explain in detail the documentation required.

To avail the loan against PPF where no collateral is required, fill form D (acquired from the bank or post office where the PPF account is opened) and give your PPF account number and the loan amount for which you have applied. Enclose your PPF account passbook and hand over these documents to the bank or post office branch.

For example, you have opened PPF account from your bank branch, and after 3 financial years of opening my account, you are eligible to avail the loan facility against my PPF. You can go to your bank branch and submit the documents like form D, PPF account number, and PPF passbook and get the funds.

There are several digital lenders as well who give funds to people with bad credit scores. We have listed some of them here.

01. Omozing.com

It gives loans to applicants who have CIBIL scores of 600+. They aim to give low-interest rates and the tenure of the loan ranges anywhere from 1- 48 months.

02. Home credit

It is an online lender that provides personal loans. The documentation entails only PAN and identity/address proof to avail loan facilities here. They don’t take your credit history into account and their EMIs are flexible.

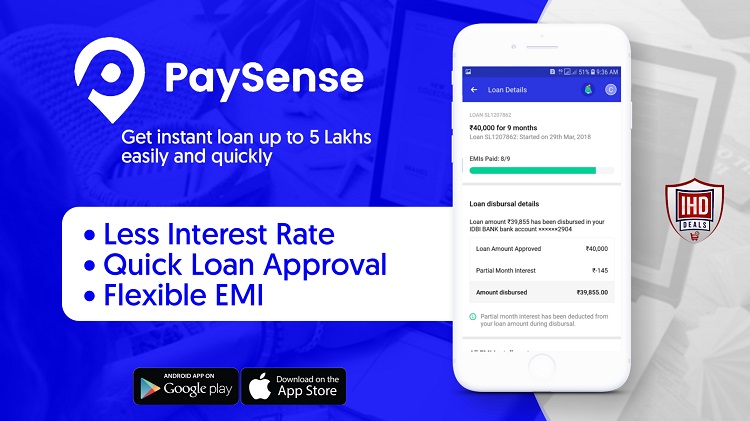

03. PaySense

It is an online lender that approves loans to people with bad credit and no credit history. The documentation process is easy and instantaneous, and the loans are approved quickly. You can adjust the EMI and tenure of the loans based on your credit scores.

04. Nira

Nira is another popular loan app in India that focuses on credit scores. You can determine whether you qualify for their loan within 3 minutes after downloading the app. You can get loan funds from them ranging anywhere between 5000-100000 INR.

05. Dhani

Dhani backed by India bulls venture, is another Industry favorite. This app also doesn’t focus on credit scores and provides you with a loan without physical documentation. You need to provide your PAN, Aadhaar, and address for verification.

06. Credit Cards

If you do not trust loan apps, you can still get a loan with bad credit. If you have a credit card, you can try getting a cash card advance. You can use the credit card as an ATM card to withdraw money from the ATM. This is an unsecured loan that doesn’t impact your credit scores. Interest is charged from when you withdraw the cash.

07. PPF

If you have a PPF (Public Provident Fund) account with the GoI, you can take a loan from your PPF account and it won’t depend on your credit scores. This facility can be availed between the third and sixth year of opening the PPF account. The extent to which you can borrow is capped to 25% of your PPF balance. The interest rate charged is 1% higher than the interest earned on the scheme.

08. Loan against insurance policies

Loan against insurance policies where the insurance policies will act as the collateral. Life insurance that has a surrender value can be pledged to the lender as collateral. These loans are sanctioned fast and have flexible repayment tenures.

All the lenders that we have listed above are registered with the RBI as an NBFC. Whenever you decide to borrow from online lenders, make sure you borrow from licensed NBFCs to operate in the money lending business. It is crucial to do your research and go for a lender registered with the RBI and operate within their framework.

Never be in a hurry to avail a loan no matter how dire your needs be. Always do your due diligence before finalizing on any lender. I have discussed some of the important things to keep in mind before you get a loan.

Things to know before applying for loans with bad credit

There is no such thing as a free lunch. So, be careful when availing a loan with a bad credit score. Some of the factors we have listed below will guide you when discussing with the lender.

- If you are availing a loan with collateral, then understand the terms and conditions of the loan thoroughly. Failure in repayment will allow the bank or financial institution to sell the collateral to recover the money.

- It is very important to go through the fine print of the loan that you are getting. It is advised to consult a financial expert or an accountant before signing anything. Take your time understanding the terms and conditions, and don’t hurry to sign anything.

- Banks and financial institutions will offer different types of interest rates. Understand the difference between fixed and floating interest rates and how this impacts your tenure and EMIs.

- The tenure of the loan and the EMI schedule will be shorter and higher, respectively, for people with bad credit. Look into the schedule thoroughly to understand whether you will be able to keep up with the repayments.

What to do to improve your credit scores?

I have discussed some steps you can take to improve your credit scores. Good credit scores are critical, and rectifying them should be your priority.

- The most obvious thing to do is stay regular with your payments. Don’t miss or default on your payments, especially utilities—showcase regular and steady repayment. You can do this by setting up automatic payments from your bank account.

- Don’t use your credit card irregularly and for huge expenses that you may not be able to pay off. One of the tricks I learned while I was in the trade was to set up regular payments to be deducted from your small credit card. For example, pay your utilities using a credit card as these amounts are small so the chances of defaulting on them are low and since they are regular payments, they boost your credit scores.

- Consider debt consolidation. If you have numerous outstanding debtsthen try consolidating all the debt into 1 loan, which will leave you paying for that one loan only. The same can be done with credit cards as well. When you own multiple credit cards, you can transfer the balance into a single card. You can discuss with your lender for further details and negotiate for better terms as well.

- Always monitor credit reports regularly and see to it that the latest information regarding your credit history has been updated. Doing this has the added benefit of preventing identity theft. For example, get a report that a new credit card has been reported on your credit file and you don’t remember opening for one. You can immediately contact the credit card company and report for suspected fraud.

- Also, check your credit report for any errors as I mentioned before. Ask for immediate correction in case there are any mistakes in your credit report.

Do these changes and you will certainly see an increase in your credit scores. Maintaining good credit scores will always work to your advantage. Having good credit scores is part and parcel of the finance world and one should learn how to navigate it.

The Final takeaway

It is possible to loan with bad credit scores in India urgently. But better financial management should be your aim as people with bad credit don’t get favorable terms and conditions on the loans they are availing. Loans with collateral and loans with co-signers are easier to get even with bad credit scores, but they often come with their caveats.

Better management of money and improving your CIBIL scores should be your long-term goals. This will help grow your savings and decrease the chances of availing loans to tide over financial circumstances. I hope the tips and suggestions given here help you in making better decisions in financial matters.

Also, we want to conclude that if you have difficulty repaying your dues, you can always speak to your lender so that he can amend the terms accordingly. No lender will be opposed to this because it is in their best interest to keep you on top of your payments.

This is all about loan with bad credit scores in India urgently.

Also read,