Are you looking for How to get an Instant cash loan in 1 hour without documents? then, you have landed in right place. Have you ever needed cash urgently to weather a difficult situation? Have you wondered where to go to arrange for money at such short notice? Look no further as instant loans are available online. As a person who went through a similar experience, I can say that several digital money lenders provide you loans with minimal documentation.

Due to the advance of the internet, several money lenders moved online, and the instant cash loan facility was born. It is a paperless procedure where loans are approved with fast processing times and minimal documentation. These loans are usually unsecured personal loans and are far more convenient than traditional bank loans.

Before you apply for instant loans, let me elucidate their features for your better understanding.

- Instant loans are short-term loans.

- The loan funds range from 5000 INR to 1000000 INR.

- It is a paperless procedure with a faster approval rate than a traditional bank.

- You can conveniently apply for such loans from the comfort of your home or office.

In case you are wondering if people go for personal loans, then let me put your mind at ease by quoting some statistics to you:

According to the RBI, personal loans thrived and recorded 13.5% growth year on year in March 2021. As per the excerpt from Financial express, a leading financial newspaper in India, 77% of people rely on personal loans to cover medical emergencies, children’s education, wedding expenses, etc.

From this, you can clearly see that availing of personal loans is common and extremely rampant. One of the reasons for using a personal instant loan is common is the eligibility criteria. There are so many digital lenders registered with the RBI that provide personal loans instantly without looking into your salary slips or income proof. I have listed the points making you eligible for an instant personal loan.

- Anyone above 18 can apply for a personal loan without any guarantor or collateral.

- Should be a resident of India

- Should have PAN card orAadhaar

The qualifications discussed above are the minimum criteria required to avail of an instant loan online. I have listed below several digital lenders that provide loans to individuals with minimum documentation (especially without salary slips) and are all registered with RBI operating within their framework.

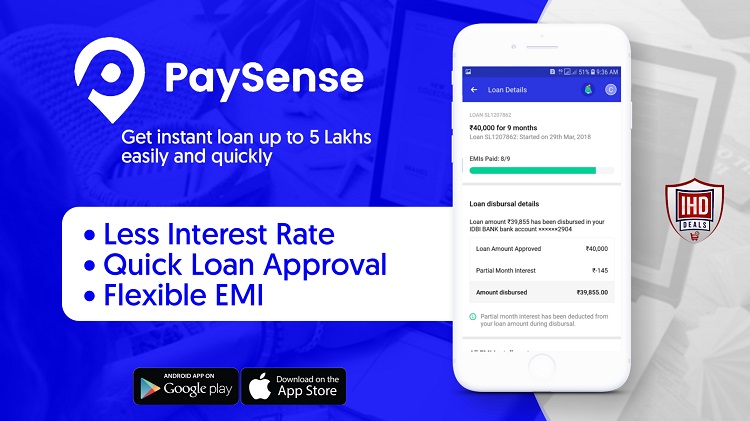

01. PaySense

PaySense, one of the best loan apps in India, which recently merged with Lazypay, brings you a variety of loans to choose from. Their loan ranges from 5000 to 500000 INR with a fast approval rate. All they require from you is PAN, Aadhaar, and proof of income. Salary slips aren’t required at all. They have flexible EMI schedules with interest ranging from 1.08-2.33% per month.

02. Dhani

Dhani is a favorite instant loan app that provides loans to people instantaneously. Only PAN cards, address proof, and bank details are required to be eligible for their loans. They do not ask for salary slips or proof of income, making it a top-rated app. The interest rate varies from 1-3.17 % per month, and the loan amount ranges between 1000 – 500000 INR.

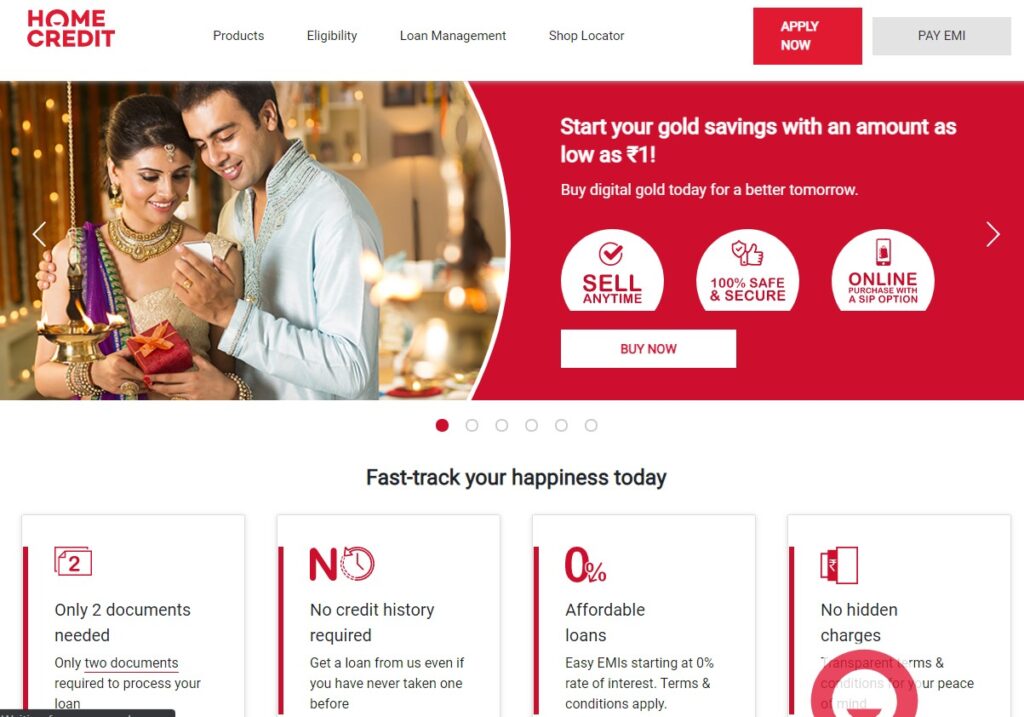

03. Home credit

Home credit is a popular loan app that easily disburses loans and people from 19-65 years can all avail this facility. The only documentation required here is PAN and address proof. The loan approval is fast, and the digital interest rate varies from 2.4 to 3.3% per month. The EMI plans are flexible, and they do not take your credit history into account. It is a favorite among students and pensioners alike.

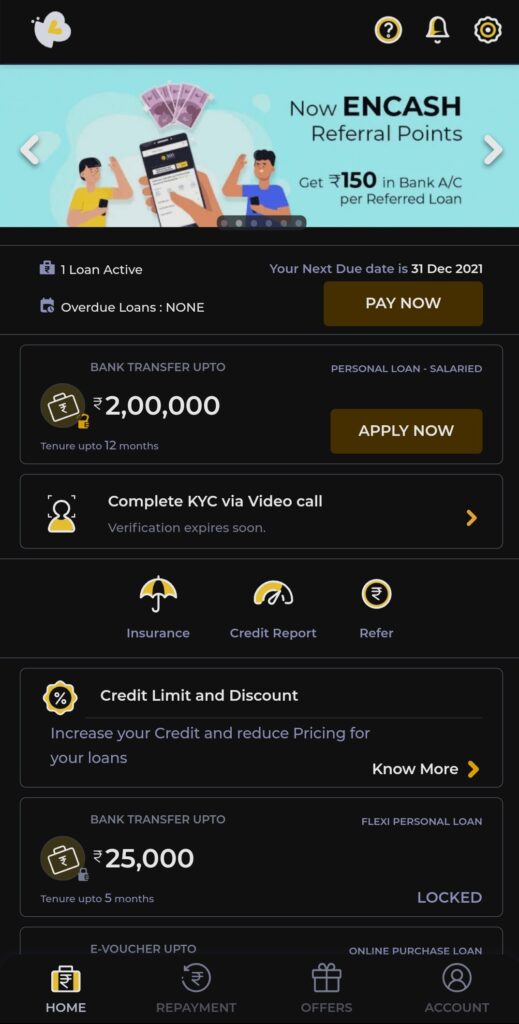

04. KreditBee

KreditBee allows users to get Instant cash loan in 1 hour without documents. Users above 18 to borrow loan using aadhar card. Their credit ranges from 1000-100000 INR with straightforward payback options. It has one of the fastest approval rates, and the funds can be disbursed within 5 minutes of approval, depending on your previous credit payback details.

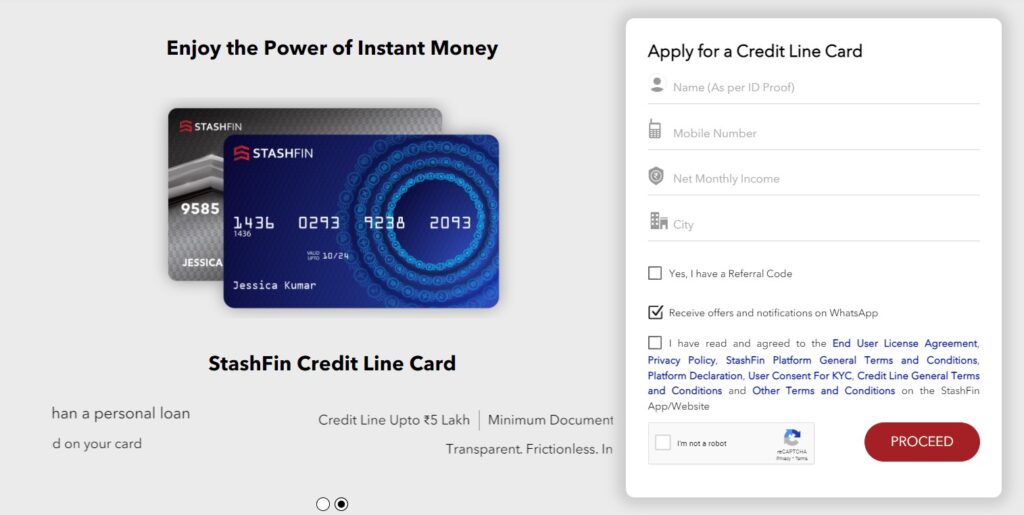

05. StashFin

It is another company that provides loans instantly with minimal documentation. All they require is to fill their online form and provide your PAN and aadhaar. Their entire procedure is transparent and has no hidden charges. Their credit ranges from 1000 – 500000 INR.

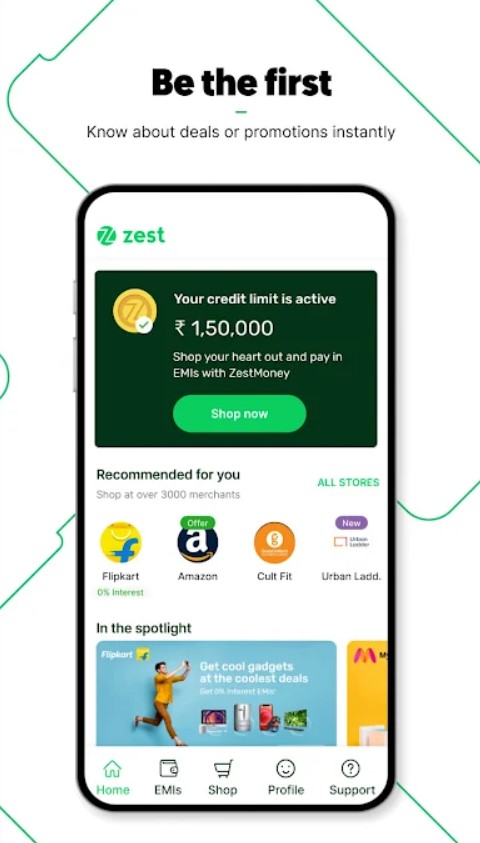

06. Zest Money

This is an app with a very friendly user interface. With only 3 steps you can get funds from them. All you need to do is download the app, set up your KYC (PAN and Aadhaar) and link your bank account digitally to them so they can directly transfer funds to your account and then you are ready to go.

There are no hidden charges, and their credit limit is up to 200000 INR.

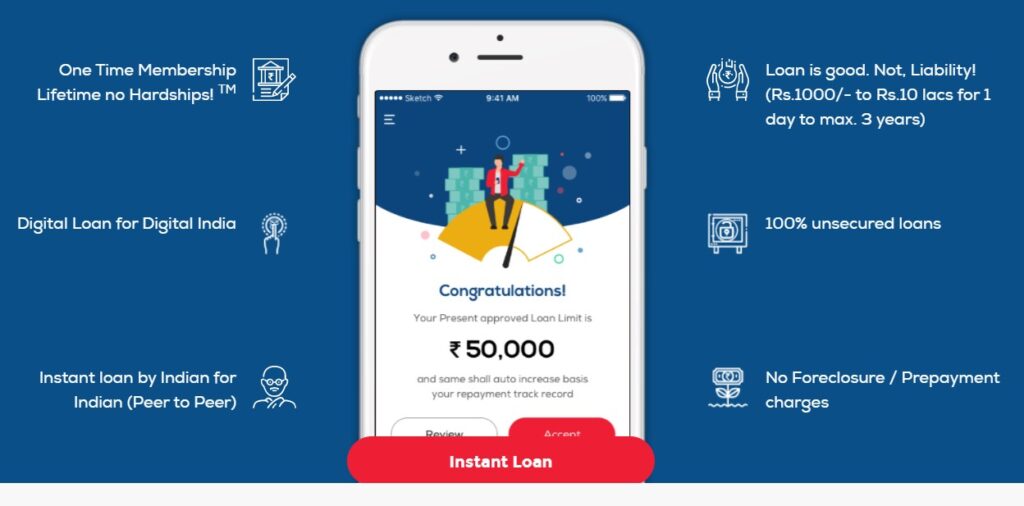

07. Cashbean

This is a money lending app that has no paperwork and other challenges. The entire procedure from loan application to loan disbursal has been digitalized and takes place online. The loan funds range from 1500 – 60000 INR.

08. Anytimeloan

This is an app that connects individuals with lending partners. They offer short-term loans without the requirement of collateral or guarantor. They offer education loans and business loans as well. There is no minimum loan amount, and the maximum loan amount is 5000000 INR.

The list above details apps in our country that lend with minimal documentation. Along with credit lines, they provide other facilities such as credit cards and loyalty point programs when you shop with their merchant partners. These online lenders have tie-ups with many merchant organizations, including pharmacies, that help you earn points that you can redeem later with many benefits.

However, industry experts advise that you make payments only to accounts registered with the RBI. So, take extra note of this when signing up for an app. Online payments are considered safe and easily traceable, but ensure you sign up with a registered company. Many online lenders have tempting terms and conditions that come with hidden riders.

The Final Takeaway

Lending apps and online lenders have made the market more dynamic and competitive. This has made gaining access to funds very easy. But this does not absolve you from reading the terms and conditions carefully before agreeing to anything. I have seen many people experience hardships after failing to keep up with their repayments.

Understand the terms and conditions thoroughly, and don’t hurry to sign anything. Pay extra attention to the repayment schedules and only decide on the loan when you feel you can keep up with your EMIs without defaulting. Do your research and compare the schemes of various lenders before finalizing anything. Be extra careful and sign for the best one and I hope you have a good experience. This is all about how you can get an Instant cash loan in 1 hour without documents?

Also read,

In need of 3000 oan for medical bills