Have you ever heard of having a zero balance account? The zero balance account is a new saving account scheme that has been launched by ICICI Bank of India. This scheme is getting more popular among the people due to the non-maintenance of the minimum balances in the accounts. People can deposit and withdraw money anytime in these accounts. But, yet there are many people who might not know much about this scheme, and with a vision to help all you out there, we are here with this article, where you can find answers to all your quarries. So, let’s start.

What are the benefits of the ICICI Zero Balance Account?

ICICI zero balance account carries various benefits that could be offered to the people. Some of the benefits are as follows:

- These kinds of accounts do not require any deposit initially. There is no minimum balance requirement for these accounts.

- There is no fixed service charge is levied on these accounts by the ICICI bank.

- The bank has levied only the annual maintenance fee on these accounts.

- The bank has not associated any other fees with these zero balance accounts.

- The bank has not levied any ATM using charge on these kinds of accounts.

- The bank has opened up the facility of free message alerts for these zero balance accounts. The user can register themselves with the banks to get the details of their transaction through message alerts.

- A user can open multiple zero balance accounts in the ICICI bank. There is no restriction imposed by the ICICI bank for opening these bank accounts.

- The users do not need to attain the age of 18 years to open a zero balance account. Any person belonging to a different age group can open this account.

- The user can do unlimited transactions using this zero-balance account.

- The terms and conditions to open these zero balance account are easy.

- The ICICI bank has provided easy customer support to the users of these accounts.

- The user can easily access these account details by using the ICICI bank mobile application.

- The fees imposed on these accounts are lower as compared to the other bank accounts.

- The bank statement for these accounts can be easily delivered by email. The user does not have to apply for physical statements in the banks.

- The user will receive the interest even after not having any balance in these accounts.

- The user can deposit an unlimited amount in these zero-balance accounts. The bank has not prescribed any specified limit for the same.

- The user can withdraw the unlimited amount in these zero-balance accounts. The bank has not prescribed any specified limit for the same.

- The bank has not put any restrictions on transferring the balance between the two savings accounts.

- These bank accounts can have separate e-wallets.

- The cash deposit is free in these zero balance account.

- The bank will provide the free passbook with all the zero balance account.

- The bank will provide internet and mobile banking to the users of these accounts on request.

What are the various documents that are required to open this zero balance account?

The bank requires the following documents to open this zero balance account from the user. The list of the document is as follows:

- One photo identity proof is required from the user (except PAN Card).

- The signed application form for opening this account.

- A self-declaration form from the user.

- A valid address from the user to open this account.

What are the two types of ICICI Zero Balance Account?

ICICI bank has offered two types of zero balance accounts to the new users. The two types of zero balance accounts are as follows:

- ICICI Insta Save FD Account

- ICICI Basic Savings Bank Deposits Account

What is the procedure for opening the ICICI Insta Save FD Account?

The procedure of opening the ICICI Insta Save FD Account is simple. The new user has to follow these steps to open this type of bank account:

- This bank account can be opened by logging into the ICICI bank website. There is no need to visit the nearest branch to open this account.

- The bank requires the video KYC from the new users opening this account by using the online modes. This will help banks to validate the identities of the new users.

- The bank will not levy any charges of not maintaining the balance amount in this account if the user opens the FD of Rs. 10,000 within three months. The bank in this condition will treat this account as a zero-balance one.

- The users of this account can avail of the credit card from the ICICI bank against their secured FD funds. The card value will be equal to 90% of the FD value.

- The joint holders are not permitted to open this account.

- The users can get a visa debit card for these accounts. These debit cards can be used to withdraw money from the nearest ATMs of the bank.

- The rewards and cashback could be earned on these debit cards against the transaction done.

- The users of this account have a special benefit of getting the insurance cover of Rs. 50,000. This insurance cover will protect the user from any kind of personal accident such as loss and theft.

What is the procedure for opening the ICICI Basic Savings Banks Deposit Account?

The procedure of opening the ICICI Basic Savings Bank deposits Account is simple. The new user has to follow these steps to open this type of bank account:

- The user first has to visit the ICICI official website.

- Then click the tab of apply online and then the tab of saving account.

- Then click on the apply tab.

- Then fill in the gender, marital status, occupation, income, residential status, and education in the application form of the savings account online.

- Then enter the PAN Card, mobile number, and email id, then click on continues.

- Then enter the generated OTP of the mobile in the application form to proceed further.

- Then enter the Aadhaar number and then proceed further. Then do the Aadhaar validation by entering the OTP received on the mobile number.

- Then add the nomination details.

- Then add the permanent and correspondence address in the application form.

- Then validate the details of the application form and proceed further.

- The terms and conditions given at the end of the application form must be accepted/

- Then try to make the minimum balance in the account and open the fixed deposit of the required amount within the three months of the opening of the account.

What are the various benefits of opening the ICICI Basic Savings Banks Deposit Account?

The various characteristics of the ICICI Basic Savings Banks Deposits Account are as follows:

- The Pradhan Mantri Jan Dhan Yojana governs the opening of the zero balance savings accounts. The people belonging to the economically weaker section can open this zero balance account.

- The Non-Resident Indians and foreign people do not open this zero balance account. The residents of India having an age of 18 years can open this account.

- The users of this account will receive a separate debit card for doing the transactions. These debit cards are free to use and no fee is applicable on these cards.

- No need to maintain the minimum balance in these zero balance accounts and no penalty would be levied by the bank.

- The users could withdraw and deposit the amount freely without paying any additional fee from these zero-balance accounts.

- All the transactions of these zero balance account would be recorded in the passbook online and in the physical form.

- The zero balance accounts that have been opened after completing the KYC process, have the potential of unlimited credit.

- The nominee could be filled at the time of opening these zero balance accounts. All the money available in these accounts would be transferred to the nominee if the main user passed away.

- The maximum balance that can be kept online basis should not exceed one lakh rupees in a year.

- The real-time gross settlement facility is not available for these accounts.

- The annual credits should not be more than two lakh rupees.

What is the interest rate of the ICICI Basic Savings Banks Deposit Account?

When it comes to interest rates, the ICICI Basic Savings Account offers a standard interest rate that is in line with major banks in India. The current interest rate on the ICICI Basic Savings Account is as follows:

| Balance Slab | Interest Rate |

| Up to Rs. 50,000 | 3.50% per annum |

| Rs 50,000 – Rs 1 Lakh | 3.50% per annum |

| Above Rs 1 Lakh | 4.00% per annum |

As evident from the table, all savings account balances up to Rs 50,000 earn a uniform interest of 3.5% per annum. For balances between Rs 50,000 and Rs 1 Lakh, the same 3.5% interest rate applies. However, any amount above Rs 1 Lakh earns a higher 4% interest.

The interest is calculated on a daily basis and credited to the savings account every quarter – in June, September, December and March.

What is the applicability of the interest rate on the ICICI Basic Savings Banks Deposit Account?

The interest rate is applied on the ICICI Basic Savings Banks Deposit Account on the following basis:

- The balance is lower than 50 lakhs on the end day, then the interest rate would be applicable with the rate of 3%.

- The balance is over 50 lakhs on the end day, then the interest rate would be applicable with the rate of 3.5%.

- The interest earned could be paid quarterly in March, June, December, and September.

What are the basic details of opening the ICICI Basic Savings Banks Deposit Account under Pradhan Mantri Jan Dhan Yojana?

The basic details of opening the ICICI basic savings bank deposits under Pradhan Mantri Jan Dhan Yojana are as follows:

- The Pradhan Mantri Jan Dhan Yojana is launched by the department of financial services.

- Under Pradhan Mantri Jan Dhan Yojana, the main credit and financial services are provided to the various sections.

- Pradhan Mantri Jan Dhan Yojana is launched to meet the vision of the “National Mission for financial inclusion.”

- The users of this account will receive free checkbooks, passbooks, and a debit card.

- The daily withdrawal limit of this account is Rs. 10,000.

How to add a nominee to the ICICI Zero Balance Account?

Their nominee to the ICICI zero balance account could be added by submitting the physical form at the bank branch or the form can be filled out online. The form must be filled with all the basic details of the nominee such as name, contact details, residential details, and other bank account details. The form must be accompanied with the relevant identity proof that could be an Aadhaar card, PAN card, driving license, rent agreement, and electricity bill. Any person who comes in close relation with the bank account owner can become the nominee for his account. In case of any mishappening in the future such as the death of the bank owner, all the funds lying in the account will be transferred to the selected nominee. The selection of nominee option is always given by the bank at the time of the opening of the zero balance account. The nominee form must have the picture of the nominee and be duly signed by him. The process of approval nominee usually takes three to four days.

How many people can be nominated ?

The ICICI Zero Balance Savings Account can only have one nominee at a time. This condition would not change even if the account is held by a single or joint owner.

Can the nominee for the ICICI Zero Balance Account be changed?

The ICICI Zero Balance Account nominee could be changed any time after submitting a proper declaration by the bank account owner. As per RBI guidelines, the account holder has the facility to change the nominee at any time after account opening. ICICI also allows its customers to change the nominee for their Zero Balance Account by submitting a formal request.

Here is an overview of the process to change the nominee for ICICI Zero Balance Account:

| Steps | Details |

| 1 | Visit the nearest ICICI Bank branch with your account details and original KYC documents |

| 2 | Submit a duly filled nomination form and KYC documents of new nominee |

| 3 | The change of nomination request will be processed by ICICI Bank |

| 4 | A confirmation message will be sent to the account holder regarding the nominee change |

Along with individuals, organizations such as companies, trusts, societies, etc. can also be appointed as nominees for the Zero Balance Account.

How a minor can file a nominee for his/her ICICI Zero Balance Account?

The legal guardian operating the ICICI Zero Balance Savings Account on the behalf of the minor can file the nominee for the same. This nominee details could be changed by the minor after attaining the age of 18. A self-declaration form is required to be filed to confirm the nominee change with the bank and the reason must be mentioned in the form.

What is ICICI Mine Savings Account?

This is also a different kind of ICICI Zero Balance Saving Account. This is a digital account that can be opened online and the account number can be generated immediately. The transaction procedure in this account is also easier for the user as compared to the other zero balance account. The minimum balance amount requirement is NIL in these kinds of accounts. The subscription fee is Rs150 (add. GST) for the normal mine accounts and Rs599 (add. GST) for the premium mine accounts. The regular cashback is received on the transactions that occurred through this account. The five ATM transactions are offered free from this account. The online bank statement for this account is received by the user. The mobile and internet banking services are open twenty-four seven for this account. This account balance can be converted into a fixed deposit at the request of the user. The virtual debit card could be generated by the user instantly after opening this account. The other accidental insurance benefits and purchase protection benefits come additionally with this account. Any person between the ages of 18 to 35 years can open this account. The person must have Indian nationality.

What is the procedure of converting the normal ICICI Bank Account into a Zero Balance Account?

The normal ICICI bank accounts could not be converted into a zero balance account. A non-existing customer of the ICICI bank could not open the ICICI zero balance account. Even a person holding a valid credit card from the ICICI bank is not eligible to open a zero balance account.

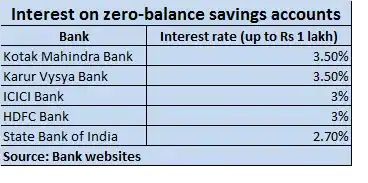

Which banks are providing the best interest rates on the Zero Balance Savings Account in the Year 2022?

The list of the banks that are providing the best interest on the zero balance savings account in the year 2021 are as follows:

- State Bank of India is providing the minimum interest rate of 2.70% on the zero balance savings accounts.

- HDFC Bank is providing the minimum interest rate of 3.00% on the zero balance savings accounts.

- Kotak Mahindra Bank is providing the minimum interest rate of 4.00% on the zero balance savings accounts.

- ICICI is providing the minimum interest rate of 3.00% on the zero balance savings accounts.

- Axis Bank is providing the minimum interest rate of 4.00% on the zero balance savings accounts.

- Yes, Bank is providing the minimum interest rate of 6.00% on the zero balance savings accounts.

- Punjab National Bank is providing a minimum interest rate of 3.75% on the zero balance savings accounts.

- Federal Bank is providing the minimum interest rate of 4.00% on the zero balance savings accounts.

- RBL Bank is providing the minimum interest rate of 6.75% on the zero balance savings accounts.

- IDFC Bank is providing the minimum interest rate of 7.00% on the zero balance savings accounts.

- DBS Bank is providing a minimum interest rate of 6.00% on the zero balance savings accounts.

What are the new notifications comes ?

As per the notification released in the year 2019, the holders of the ICICI Zero Balance Account are required to pay the nominal fee of Rs100 to Rs125 on every transaction. The fee that would be levied on the first two cash transactions of this account is Rs100 and then after all transactions would be charged with the fee of Rs125.

What are the cheque return charges ?

The cheque return charges for the above mentioned ICICI bank account are as follows:

- The cheque is returned inward due to any non-financial reason then the charges would be Rs50 per cheque.

- If the cheque returns inward for any financial reason, then the charges would be Rs500 per cheque.

- If the cheque returns outward for any financial reason, then the charges would be Rs200 per cheque.

- In case of outstation cheque deposit, the charges would be Rs.150+ other bank charges.

What are the charges of getting a duplicate passbook ?

The charges of getting the duplicate passbook for the ICICI zero balance account are Rs100 for the passbook issue and Rs25 per page for updating the whole passbook.

What are the charges of getting loose cheques leaves ?

The charges of getting the loose cheques to leave for the ICICI zero balance account is Rs25 per leaf and for a checkbook having five leaves, the charges would be Rs125 per checkbook.

What are the charges of getting the balance certificate ?

The charges of getting balance certificate of the ICICI zero balance account are as follows:

- Rs50 per certificate for saving balance account and fixed deposit balance.

- Rs100 per certificate for saving balance account and fixed deposit balance comes under the INR & US dollars.

What are the charges of speed clearing services ?

The charges of speed clearing services of the ICICI zero balance account are as follows:

- If the amount is less than rupees one lakh, then the speed clearing charges will be NIL.

- If the amount is more than rupees one lakh, then the speed clearing charges will be Rs150 per instrument.

What is the daily withdrawal limit of the debit card?

The daily withdrawal limit of the debit card of the ICICI Zero Balance Account is Rs10,000. Besides, the daily withdrawal limits ICICI debit cards depend on the type of card and account held by the customer. Here is an overview of the daily ATM withdrawal limits:

Maestro Debit Card

| Account Type | Daily ATM Withdrawal Limit |

| Savings Account | ₹25,000 |

| Salary Account | ₹40,000 |

| NRI and NRE Accounts | ₹50,000 |

As seen from the table, savings account holders have a daily withdrawal cap of ₹25,000 when using an ICICI Maestro debit card. Meanwhile, salary account customers can withdraw up to ₹40,000 in a day. The highest daily limit of ₹50,000 is applicable to NRI and NRE account holders.

Visa Electron/ Rupay Debit Card

| Account Type | Daily ATM Withdrawal Limit |

| Savings Account | ₹10,000 |

| Salary Account | ₹25,000 |

| NRI and NRE Accounts | ₹50,000 |

For Visa Electron and RuPay debit cards, the limits are lower compared to the Maestro cards. Savings account customers can only withdraw ₹10,000 per day while salary account holders have a higher ₹25,000 limit. Similar to the Maestro card, the maximum withdrawal of ₹50,000 per day is allowed on NRI and NRE accounts.

In addition to the above ATM withdrawal limit, ICICI also has a purchase limit on its debit cards which varies based on card type and customer segment. Customers can check their card’s applicable limits by contacting the bank’s customer care center.

Also read,

Online account open

Thank you for your response. Kindly go through the article to know how you can easily open your account online.

Account kholna he

Thank you for your response. Kindly go through the article to know how to open an account.