Instant loans are considered so quick that they are called 1-hour loans. These loans can be easily availed online through apps on the market and help you in times of emergencies. Gone are when people would approach their banks, wait in queues, submit various documents and meet many bankers to convince them to give them a loan.

Now, everything happens at the press of a button. Instant loans are quick, easy, have minimal documentation, and have super-fast processing times. The funds will directly be credited to your bank account and all this will be done in 1 hour while you sit and relax in the comfort of your home.

When facilities have gotten this good, we believe that it is our duty to help our readers become aware of the latest trends in the financial world. That is why we have listed some of the best apps that you can download to your phone and instantly avail themselves. They offer other facilities like the point of sales facilities, but they also offer membership discounts and credit points that can be availed at merchant organizations.

Renowned loan apps and their features

We have listed some of the best loans apps available in the market today. This list is by no means exhaustive but will help you in your quest to find a good and affordable lender who is offering competitive market rates. Now, without further ado:

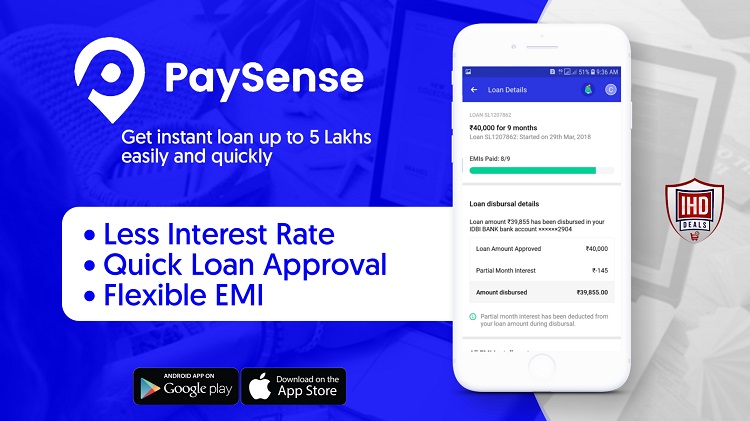

01. Pay sense

This is the leading online lender of instant loans and recently merged with lazypay. They offer a variety of loans without collateral. Pay sense is registered with the RBI as an NBFC, and the amount you can borrow ranges from 5000 to 500000 INR with a very fast approval rate. You need to submit PAN, Aadhaar, and proof of income. Salary slips aren’t required and have flexible EMI schedules with interest ranging from 1.08-2.33% per month.

02. Dhani

This app is a well-known money lending app available in the market, and they require only PAN card, address proof, and bank details. You don’t have to submit your salary slips or proof of income. The interest rate varies from 1-3.17 % per month, and the loan amount ranges from 1000 – 500000 INR, making it a popular app, especially among students.

03. Home credit

It is another popular app in India that asks only PAN and address proof. The digital interest rate varies from 2.4-3.3% per month with flexible EMI schedules. They also don’t focus on your credit scores, making it a darling of the financial industry. They approve loans fairly quickly, and anyone between 19-65 years can use this app.

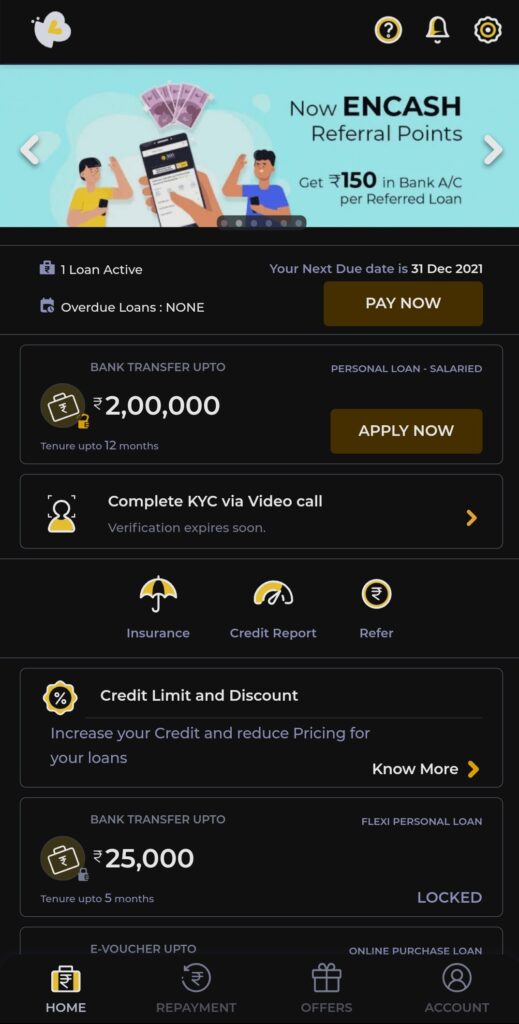

04. KreditBee

It is a fast-growing online lender that allows users above 18 to borrow from them. They have simple payback options and can disburse funds within 5 minutes of approval. Their credit ranges from 1000-100000 INR with razor-fast approval rates, provided you have a credit history.

05. Stashfin

It is a company that disburses instant loans with minimal documentation. They require only PAN and Aadhaar from you, and they have no hidden charges. Their credit ranges from 1000 – 500000 INR.

06. Zest money

It is one of the leading apps in instant loans known for its very friendly user interface. Their process is easy and simple and can be completed in 3 steps only. There are no hidden charges, and all you need to do is download the app, set up your KYC (PAN and Aadhaar), and digitally link your bank account. They will directly transfer the funds to your bank account post-approval. Their credit limit is up to 200000 INR.

07. Cashbean

It is a famous money lending app that has digitalized the entire process without paperwork and other challenges. The loan funds range from 1500 – 60000 INR, and even the verification and KYC procedure takes place online, unlike some other apps.

08. Anytime loan

It is a well-known app that connects users to lending partners; it operates on a peer-to-peer platform and provides collateral-free loans. They offer education and business loans without requiring a guarantor, and there is no minimum loan amount, and the maximum loan amount you can borrow is 5000000 INR.

09. Money Tap

It is an easily recognizable app available on all app stores. They have flexible EMIs running up to 36 months, and they charge interest only on the amount utilized.500000 INR is the maximum amount you can borrow from them.

10. Nira finance

This is a prestigious app and is the most downloaded app in the market. They disburse loan funds from 3000 to 500000 INR. If your credit scores are good, it will instantly grant you a loan. It comes with no processing charges and is also 100% paperless for documentation for the loans.

The apps mentioned above work within the framework of the RBI and follow the correct process to recovery when you default on your payments. It is very necessary to do proper due diligence before finalizing on a lender online as the market is flooded with many online lenders who offer attractive rates, and the competition is very fierce.

Beware of scammers

As we have mentioned previously, the marketplace is flooded with online lenders offering 1 hour loans by phone in India and shows very attractive terms. As the saying goes, there is no such thing as free lunch. It would be best to be cautious when you come across such lenders offering terms and conditions that are too good to be true.

Ensure the lender is registered with RBI, operating based on their guidelines. Don’t agree to any terms and conditions without verifying anything. Talk to them regarding their recovery process and make sure you understand how they charge their fees and interest rates. Also, make sure they don’t share your personal information with third-party marketers. Otherwise, you will be inundated with many unwanted calls.

Don’t be in a hurry to sign anything online. Take your time, compare many lenders, look into their offers, and select the one best suited to your needs. Please note instant loans might disburse money easily, but it will come with riders, and it is your responsibility to act in your best interest.

Which Loan Apps Are Banned in India?

The rapid growth of digital lending apps in India has led to some apps that engage in predatory lending practices and violate regulations. This has prompted action from the Reserve Bank of India (RBI) and state governments to ban certain loan apps.

The table below shows some of the major loan apps that have been banned in India as of February 2023:

| Loan App | Banned By | Reason for Ban |

| KOKO Loan | RBI | Violations of lending norms |

| Loan Gram | Telangana government | Harassment of borrowers over repayment |

| Cashbean | Telangana government | Same as above |

| Creditcoin | Telangana government | Same as above |

| Dhana Dhan | RBI | Chinese links |

| Spark Cash | RBI | Chinese links |

| 10MinuteLoan | RBI | Chinese links |

The reasons for banning these apps include harassment of borrowers over repayment, violations of RBI guidelines on lending such as full disclosure of lending rates, and apps having Chinese links which raises security concerns.

The RBI has also released a whitelist of approved digital lending apps. Any app not on the whitelist is effectively banned from lending. There are currently around 30 apps on the approved list based on criteria like parent company financials, lending practices disclosure, and data security standards.

The banned apps typically fail to meet compliance standards on data handling, have opaque disclosure terms, lend arbitrarily at high rates from unapproved sources, and have inadequate grievance redressal systems. Their recovery tactics are often unethical.

Conclusion

To answer one of the most commonly asked question ‘How to get 1-hour loans by phone in India?’ We have presented this post that lists well-recognized apps in the market. We have highlighted their features and their interest rates as well. In today’s digital age, instant loan is very convenient and hassle-free. It helps in tiding over unfavourable times and can be accessed through a button click.

But at the same time, you need to be cautious and research properly before finalizing on a lender. Always keep your credit scores handy and maintain a good credit history. This will further enhance your chances of accessing better credit. With this, we hope you make good decisions that will have positive repercussions in the future.

Also read,

How to get an Instant cash loan in 1 hour without documents?