The digital age has completely changed the way people bank and borrows funds. With the advent of the internet, lenders have gone online and have started offering instant loans. It is a paperless process that is way faster than the traditional loan. These loans can be used for any purpose and come as a boon in your time of emergency.

We aim to create awareness of the existing opportunities and trends in the financial world. Hence, we have composed this blog to inform you about instant loans. These loans don’t need time to get approved and are disbursed without any asset showcase. They are also called quick loans.

Features of Instant loan

Instant loan is different from the traditional loan, and I have listed the differentiating features:

- These short-term loans have tenures between 6 months and 2 years.

- The loan amount can vary from 5000 to 5000000 INR.

- It has a very fast processing time compared to traditional loans.

- Instant loan facility is available online only, whereas traditional loan facility is available both online and offline.

- You can apply for these loans from the comfort of your home without going to the bank.

- Instant loans get approved on the same day of application.

- Cuts down on human interaction.

- Unlike a traditional bank, online lenders provide this service even during weekends, all seven days of the week at all times.

Eligibility of applicants

Unlike SBI Mudra loan, anyone can apply for an instant loan online as long as they are a citizen of India and age anywhere between 18 and 60 years. Your profession doesn’t matter as this facility is available to all, including self-employed, entrepreneurs and salaried folks.

CIBIL scores aren’t mandatory and depend on the online lender. Some ask for your scores, and some don’t. Having documents like Aadhaar and PAN is necessary to avail this facility.

Documents required for Instant cash loan 24/7 in India

I have categorized the documents that online lenders usually ask for and list them below. The documentation differs from lender to lender and this is not an exhaustive list but should give you the general picture.

- Identity Proof: Aadhaar Card, PAN, Driving License, Passport are ID proof

- Address proof: Electricity bill, Gas bill, telephone bill. If your Aadhaar address is the same as the current address, that also works fine.

- Photos: Latest color passport size photograph

- Salary Slips: Latest salary slips ranging anywhere from 3 and 6 months is required

- Bank Statements: Bank statements are for self-employed and entrepreneurs to submit, though may also salaried people to do the same.

Fees and charges

The fees and charges aren’t uniform across all lenders and vary from lender to lender. They usually have processing fees and taxes to take into consideration. The interest rates also vary from lender to lender.

How to select an online lender for Instant cash loan 24/7 in India?

Selecting an online lender is a very important process, and you should not take it lightly. Proper due diligence is required before you finalize on a lender. First and foremost, look into the lender and see if RBI has licensed them to operate. They should work within the guidelines of RBI.

Then look into the terms and conditions they are offering. Compare multiple lenders to get the best competitive rates at no additional costs. Since processing and approval of loans are instant, you should spend more time researching the best lender available online.

We have also listed some online lenders below who are licensed by RBI and operate within their framework.

Places to get Instant cash loan 24/7 in India

01. Cashe

It is India’s most accessible online lender. They are registered with the RBI as an NBFC. They disburse loan funds ranging from 1000 to 400000 INR without collateral, ranging from 3 months to 1.5 years. The money is credited directly to your bank account once your application has been approved. Their Social Loan quotient feature sets them apart from other online lenders and is one of their USPs.

02.BajajFinserv

BajajFinserv is a leading online lender and registered with RBI in 2007. They have many financial products and are not limited to loans only. They also sell insurance and provide fixed deposit services and credit card services as well.

Many traditional banks also have taken up online lending. If you have an account with these banks then getting a personal loan online from them won’t be a hassle at all as they will have all your documents with them and processing will be instant. Banks like HDFC, ICICI, Kotak, Axis, SBI all offer instant loan facilities. Also, all of them are registered with the RBI, so they are a safer option compared to other NBFCs operating online.

03. Rupeecircle

It is another online lender that is registered with the RBI and works on an interesting model. It is a platform that connects both investors and borrowers. Borrowers can get loans easily, and investors can invest in these loans and get a steady income, creating a win-win for both parties. It is a peer-to-peer lending platform.

04. Ujjivansfb

Ujjivan small finance bank is an RBI registered bank that is into microfinance and gives instant loans at competitive interest rates. They provide this facility to salaried as well as self-employed professionals. Since it is a bank they provide banking services as well. You do not need to have an account here to get a loan from them.

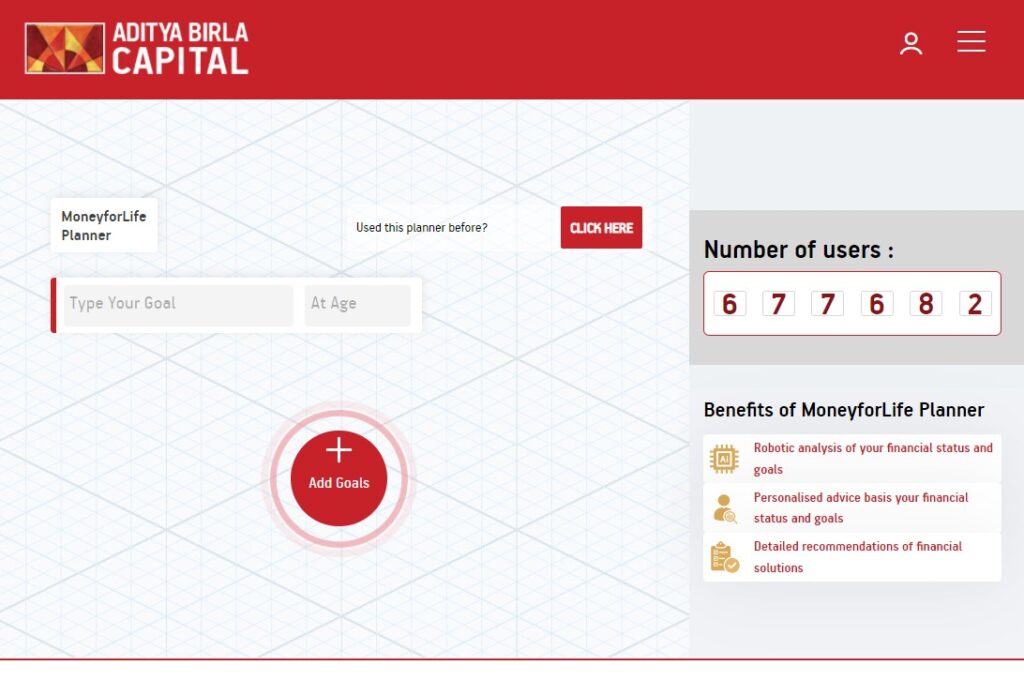

05. Aditya Birla Finance Limited

Aditya Birla Finance Limited is registered with the RBI as an NBFC and offers a variety of instant loans online. They also have investing services along with lending services. They also provide financial consulting services and are quite active in the market.

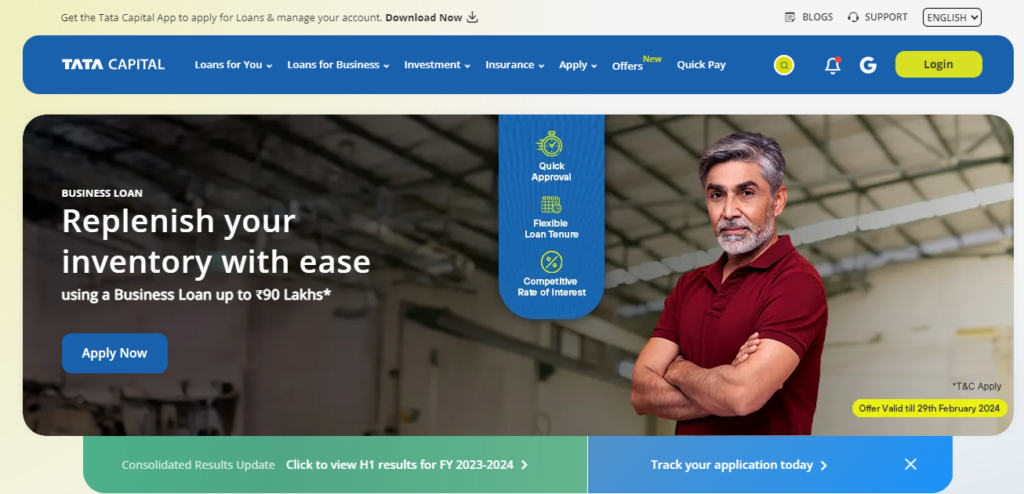

06. TATA Capital

Image Source: Tata Capital

TATA Capital is a financial services company that provides consumer loans, business loans, mortgages, and all other types of lending. In 2007, as a subsidiary of the TATA Group conglomerate, TATA Capital was founded. TATA Capital has now grown into one of the leading NBFCs in India with operations covering corporate finance, infrastructure finance, wealth management and more. Some key financial figures are shown below:

| 2017 | 2018 | |

| Revenue | ₹5,036 crore | ₹6,995 crore |

| Net Profit | ₹811 crore | ₹1,087 crore |

| AUM | ₹45,055 crore | ₹56,921 crore |

07. TATA NEU

Image Source: TATA Digital

TATA Neu is a super app introduced by the TATA Group in April 2022 to allow users to gain access to multiple services on a single platform. It is a platform that bundles all the offerings from TATA’s consumer businesses in retail, payments, travel, health, grocery and more. TATA Neu, as of November 2022, has a user base of over 25 million and an annual gross merchandise sales of $2 billion, as shown in the below figure.

| Metric | Statistic |

| Registered Users | >25 million |

| GMV | >$2 billion |

The list mentioned above is by no means exhaustive but are well-known companies that have been in the financial markets for a long time and provide a host of financial services. They all have websites online that have all the details and provide a lot of information on their services.

Conclusion

Online lending has become easy and instantaneous. Most of the instant loans don’t require any collateral and disburse funds in record time. Looking at this lucrative opportunity, many banks have entered this foray and provided the same service.

Getting an instant loan is easy as this facility can be availed anytime during the week whenever it is convenient for you. We have written this blog hoping that it will guide you in making better decisions regarding selecting an online lender and increase your knowledge of the procedure and services they follow.

This is all about Instant cash loan 24/7 in India.

Also read,